Funding to fuel your business

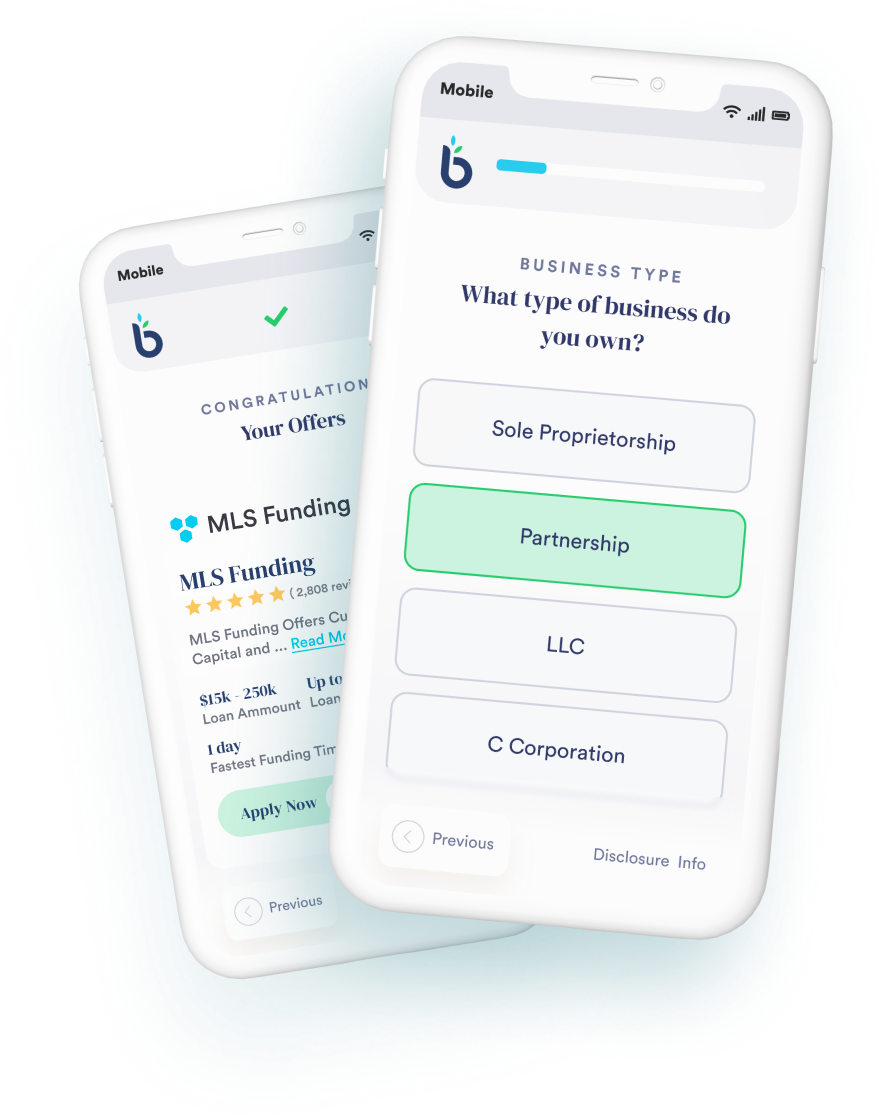

Compare multiple loan options at once and choose the best fit for your needs with confidence.

Get Startedhow it works

the process

Answer some basic questions in less than 3 minutes with no impact to your credit score and compare multiple offers. YOU are in the driver’s seat!small business enthusiast

what we do

Using proprietary technology, we quickly review your business information and match you with the right lending partners. We are connected to a vast network of lending professionals we handpicked to help fund your capital needs. With loan standards frequently changing, we stay on top of it all for you to deliver the right lenders at the right time.There are several different loan types available in the market. Here are a few you may encounter while considering options.

Short Term Loan

A loan that is set to be paid back in a short period of time—typically within a year or two, sometimes longer. Most common uses include working capital, inventory or equipment purchases, and marketing. Short term loans also typically allow for quicker and easier access to funds with more flexible underwriting standards.

Long Term Loan

A long-term loan is smart to consider when making a large investment or looking to expand, typically 5 to 10-year terms with potential up to 20+. These loans can have a fixed or floating interest rate. Longer term loans may also require collateral, such as real estate to be pledged when securing the loan.

Line of Credit

A revolving loan that provides a fixed amount of capital and that can be accessed when needed. Unlike a traditional term loan, all or part of a line of credit can be accessed on demand up to a fixed limit. The customer pays interest only on the outstanding principal amount in use.

Merchant Cash Advance

While not technically a loan, a cash advance typically does not require a true Personal Guarantee so may be riskier for the lender. Cash advances generally do not have a set term, payment schedule, or stated interest rate like a traditional loan. Instead, cash advances typically have a total payback and purchase a fixed percentage of the customer's future cash receivables.